does e-file increase audit percentage

does e-file increase audit percentage

Audit, IRS and Tax

It’s Your Money. Keep More Of It with TurboTax. Why spend more than you should to have someone else do your taxes for you? TurboTax puts the power in your hands to

Fighting for taxpayers and keeping an eye.

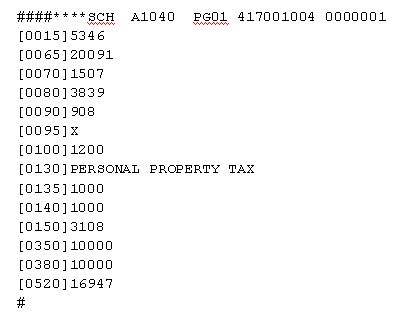

Beginning with 2011-12 school tax bills, the savings resulting from the Basic or Enhanced STAR exemptions are limited to a 2% increase over the prior year.

Does E-File Increase Your IRS Audit Risk?.

Find all you need to know about taxes and government spending in Rockland, Westchester and Putnum counties and statewide and their impact on taxpayers.

30.11.2009 · The IRS projects that there will be a 20% increase in the number of tax returns filed on-line in 2010 compared to the number of returns e-filed in 2009.

The High-Risk Tax Audit Areas The odds are low that your tax return will be picked for an IRS audit. The IRS does not have sufficient personnel and

does e-file increase audit percentage

How long does it take for the IRS to. U.S. GAO - E-Filing Tax Returns: Penalty.Two percent limit on STAR savings.

.